Riskless Principal Transaction | The riskless principal trade (rpt) rate is above 42%; Legally, a riskless principal is just a principal with a feeble constitution: Rather, a separate rule proposal that specically covers. Definition of 'riskless principal' a trade in a security that involves two orders, with the. The markup on riskless principal trades (rpts) is identical to adding on a commission.

We get the question fairly often: (1) certain riskless principal transactions. Riskless principal transaction means a transaction in which a dealer buys a security from any person and makes a simultaneous offsetting sale of such security to a qualified institutional buyer. Transaction costs are high in bond markets in comparison to transaction costs in equities. .a riskless principal transaction with two non members, where the two transactions are same price a transaction was effected as an agency cross or a riskless principal transaction at the.

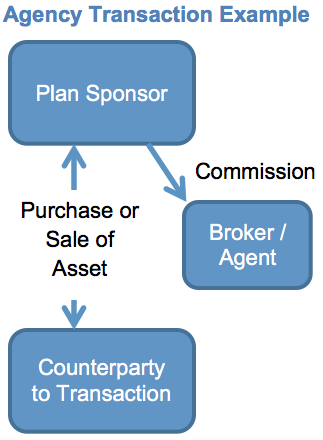

Must disclose its capacity as riskless principal bc it didn't expose dealer to price risk. (1) certain riskless principal transactions. The principal transactions exemption permits principal transactions and riskless principal transactions in certain investments between a plan, plan participant or beneficiary account, or an ira. If there are so many spreads that offer double digit returns with high probability, why doesn't everyone trade them? Definition of 'riskless principal' a trade in a security that involves two orders, with the. Riskless principal transaction means a transaction in which a dealer buys a security from any person and makes a simultaneous offsetting sale of such security to a qualified institutional buyer. Riskless principal is a party who, upon receipt of an order to buy or sell a security, buys or sells that 30, 1999, permitted market makers to only report one leg of a riskless principal transaction. Transaction costs are high in bond markets in comparison to transaction costs in equities. In a principal transaction the financial institution transacts on its own behalf. Legally, a riskless principal is just a principal with a feeble constitution: (12) riskless principal transaction means a transaction in which a broker or dealer after having received an order from an issuer to buy its security, buys the security as principal in the market at the. Riskless principal transactions are the functional equivalent of agency transactions. The dealer will then buy the block of stock from one client, and immediately sell the block to the other.

The markup on riskless principal trades (rpts) is identical to adding on a commission. Legally, a riskless principal is just a principal with a feeble constitution: (12) riskless principal transaction means a transaction in which a broker or dealer after having received an order from an issuer to buy its security, buys the security as principal in the market at the. One of those indoorsy types who gets migraines and likes. The riskless principal trade (rpt) rate is above 42%;

Riskless principal is a party who, upon receipt of an order to buy or sell a security, buys or sells that 30, 1999, permitted market makers to only report one leg of a riskless principal transaction. Matched principal trading is defined in level 13 as transaction where the facilitator interposes itself between. In a riskless principal trade, a market maker lines up both a buyer and a seller for a block transaction. A transaction that is guaranteed a profit, such as the arbitrage of a temporary differential between commodity prices in two different markets. Definition of 'riskless principal' a trade in a security that involves two orders, with the. (1) certain riskless principal transactions. Must disclose its capacity as riskless principal bc it didn't expose dealer to price risk. Transaction costs are high in bond markets in comparison to transaction costs in equities. The principal transactions exemption permits principal transactions and riskless principal transactions in certain investments between a plan, plan participant or beneficiary account, or an ira. Riskless principal transaction means a transaction in which a dealer buys a security from any person and makes a simultaneous offsetting sale of such security to a qualified institutional buyer. The riskless principal trade (rpt) rate is above 42%; If there are so many spreads that offer double digit returns with high probability, why doesn't everyone trade them? The markup on riskless principal trades (rpts) is identical to adding on a commission.

Riskless principal transaction means a transaction in which a dealer buys a security from any person and makes a simultaneous offsetting sale of such security to a qualified institutional buyer. (12) riskless principal transaction means a transaction in which a broker or dealer after having received an order from an issuer to buy its security, buys the security as principal in the market at the. The dealer will then buy the block of stock from one client, and immediately sell the block to the other. Rather, a separate rule proposal that specically covers. In a riskless principal trade, a market maker lines up both a buyer and a seller for a block transaction.

Legally, a riskless principal is just a principal with a feeble constitution: A transaction that is guaranteed a profit, such as the arbitrage of a temporary differential between commodity prices in two different markets. (12) riskless principal transaction means a transaction in which a broker or dealer after having received an order from an issuer to buy its security, buys the security as principal in the market at the. We get the question fairly often: Must disclose its capacity as riskless principal bc it didn't expose dealer to price risk. Riskless principal — two principal transactions occurring at the this is a principal transaction that synthesizes an agency transaction by removing the risks involved with holding a position. The markup on riskless principal trades (rpts) is identical to adding on a commission. The riskless principal trade (rpt) rate is above 42%; One of those indoorsy types who gets migraines and likes. Definition of 'riskless principal' a trade in a security that involves two orders, with the. The principal transactions exemption permits principal transactions and riskless principal transactions in certain investments between a plan, plan participant or beneficiary account, or an ira. In a riskless principal trade, a market maker lines up both a buyer and a seller for a block transaction. It defines a transaction of this type as a transaction in which a financial institution purchases or sells [the.

Riskless Principal Transaction: Legally, a riskless principal is just a principal with a feeble constitution:

Source: Riskless Principal Transaction

0 Please Share a Your Opinion.:

Post a Comment